Information,

intelligence

&

insight for

housing,

construction &

development.

Information,

intelligence

&

insight for

housing,

construction &

development.

Information,

intelligence

&

insight for

housing,

construction &

development.

Information,

intelligence

&

insight for

housing,

construction &

development.

Information,

intelligence

&

insight for

housing,

construction &

development.

Information,

intelligence

&

insight for

housing,

construction &

development.

Information,

intelligence

&

insight for

housing,

construction &

development.

Information,

intelligence

&

insight for

housing,

construction &

development.

Information,

intelligence

&

insight for

housing,

construction &

development.

- Housing

- Finance

- People

- It

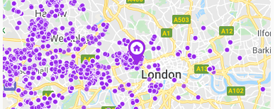

- GIS Stock Mapping

- Repairs

- Planned Works

- ENERGY PERFORMANCE

- Retrofit

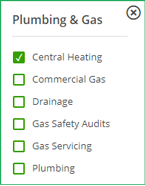

- Gas Servicing

- Central Heating

- Fire Safety

- Voids

- Roofing

- Construction

- Benchmarking

- Research

Introducing LOCARLA

Taking you to the heart of what

sets us apart from other tender

portals, business intelligence web

sites, and marketing lists.

Why LOCARLA?

We are public sector centered, built

environment specialists, with the

largest resource of social housing,

housing association,

& local

government information available.

Why buy your information from

multiple sources when we pride

ourselves on having the best and

can't

be beaten for value?